Protecting Wealth in the USA: A Practical Legal Overview

In the United States, financial risk is a reality for anyone who owns property, runs a business, or earns a high income. Lawsuits, creditor claims, and unexpected liabilities can arise without warning. When they do, unprotected assets are often vulnerable. This is why wealth protection has become a necessary part of responsible financial decision-making.

Protecting assets is not about assuming something will go wrong. It is about acknowledging that risk exists and taking reasonable, legal steps to reduce exposure before problems arise.

What Is Asset Protection?

What is asset protection is a question that typically comes up once people understand how easily assets can be exposed in the U.S. legal system. Asset protection refers to lawful methods used to shield assets from future lawsuits, creditor actions, and court judgments. The goal is to reduce financial loss by structuring ownership in a way that limits access by third parties.

Asset protection does not involve hiding assets or avoiding legal obligations. U.S. courts closely examine intent and timing. Instead, asset protection relies on legal separation, proper ownership structures, and compliance with federal and state laws. Commonly protected assets include real estate, savings accounts, investment portfolios, business interests, and retirement funds.

Why Asset Protection Is So Important in the USA

The American legal environment is highly litigious. Claims can come from car accidents, business disputes, professional services, employment matters, or contractual disagreements. Even when a claim lacks merit, legal defense costs can be financially draining.

Without safeguards, assets such as homes, savings, or investments may be subject to liens, garnishment, or forced sale. Asset protection reduces the likelihood that a single legal issue will cause permanent financial damage.

In addition to legal risk, asset protection supports long-term stability. It helps ensure that wealth remains available for retirement, education, family support, and future investments rather than being lost to preventable disputes.

The Role of Asset Protection Planning

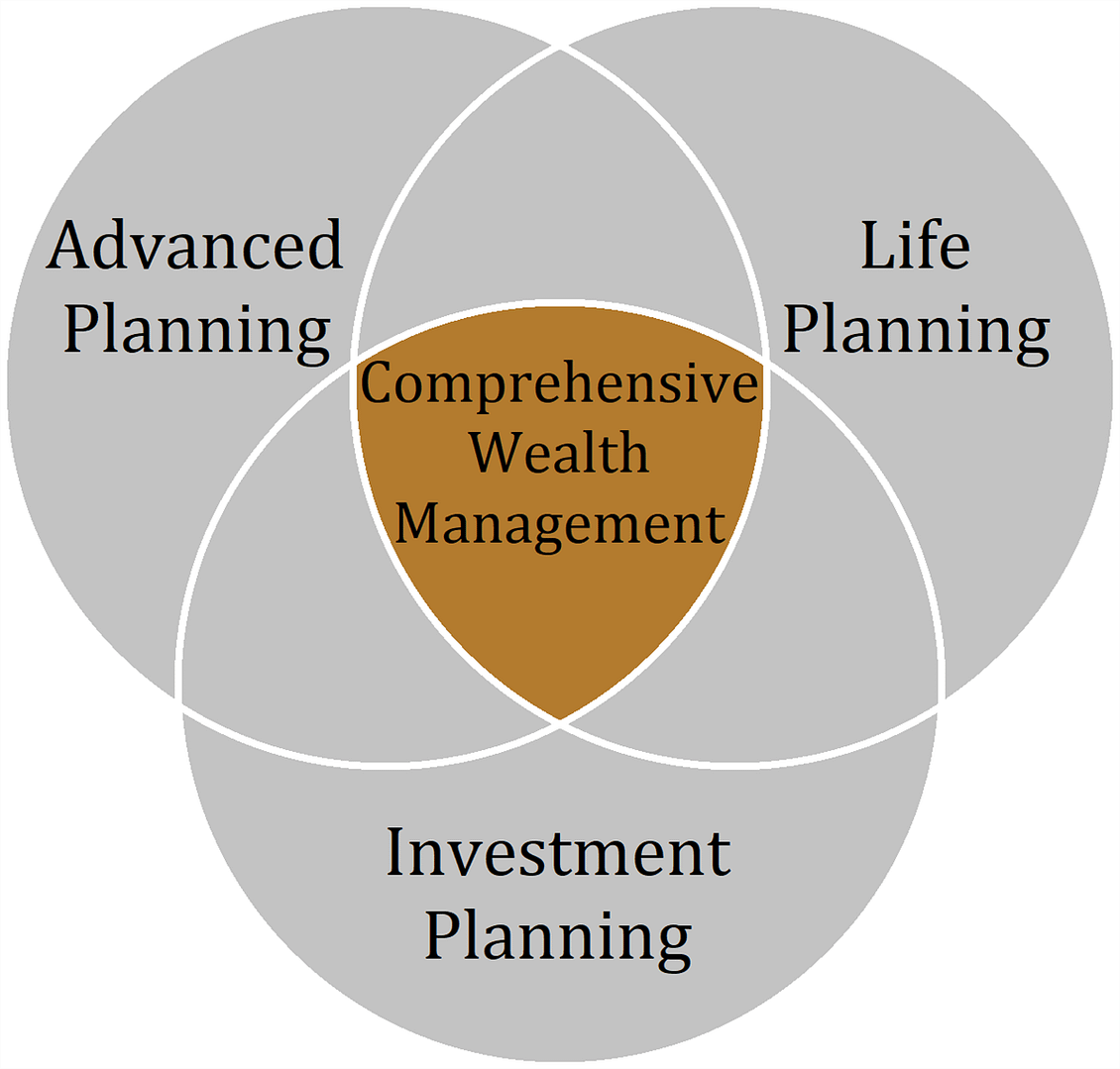

While asset protection explains the concept, asset protection planning focuses on how protection is achieved. Asset protection planning is the proactive process of identifying risks and organizing assets in a legally defensible way.

This process often overlaps with financial planning and estate planning. It examines how assets are owned, where liabilities originate, and how different ownership structures are treated under U.S. law. Asset protection planning is most effective when done early, before any legal threat exists.

Once a lawsuit or creditor claim has begun, courts may restrict asset transfers. Early planning allows more flexibility and stronger legal support.

How Asset Protection Planning Works in Real Life

Asset protection planning works by creating layers of defense rather than relying on one solution. One layer may involve separating personal assets from business activities. Another layer may involve legal ownership structures that reduce direct exposure.

Insurance is often the first layer of protection, covering legal costs and claims before assets are at risk. Documentation, compliance, and consistency are critical, as courts will disregard protections that exist only on paper.

The objective of asset protection planning is risk control, not risk elimination. It provides balance between access to assets and legal protection.

Personal Asset Protection Considerations

For individuals, asset protection planning focuses on protecting personal wealth from everyday risks. This includes safeguarding primary residences, savings, investment accounts, and future income.

Asset ownership matters greatly. How an asset is titled can determine whether it is reachable by creditors. Reviewing ownership structures and beneficiary designations is an essential step in personal asset protection.

Family considerations also play a role. Clearly defined ownership arrangements reduce confusion and disputes, particularly when significant assets are involved.

Asset Protection Planning for Business Owners

Business owners face higher legal exposure than most individuals. Customer disputes, employee claims, contract issues, and regulatory penalties can all affect financial stability.

Asset protection planning helps business owners isolate business risk from personal wealth. This requires proper formation, ongoing compliance, and disciplined financial practices. Courts may ignore protections if businesses are not operated correctly.

Business-related assets such as brand names, systems, and proprietary processes should also be structured to reduce liability while preserving value.

Legal Boundaries and Timing

U.S. law strictly prohibits transferring assets to avoid existing creditors. Courts look closely at intent, timing, and financial condition when reviewing asset transfers.

This is why asset protection planning must be done before legal trouble arises. Ethical planning focuses on prevention and lawful risk management, not evasion.

Conclusion

Protecting wealth in the United States requires foresight and responsible planning. Understanding how asset protection works and applying structured asset protection planning helps individuals and business owners reduce risk while staying within the law.

When done early and correctly, asset protection provides stability, confidence, and long-term financial security in an unpredictable legal environment.